FAQ’s about our service

Is there any charge for tracing my pensions?

We do not charge a fee to trace your pension however, if you elect to do business with us we may charge a fee or commission.

What type of pensions can findapension.ie search for?

We can trace Occupational Pension Schemes (Defined Benefit Defined Contribution and AVCs), Personal Pensions (RAC’s), Person Retirement Bonds (also known as Buy Out Bonds), PRSA’s and Self Invested Pensions. We cannot trace public sector schemes, further information on public sector schemes can be found here

How long does the process take?

This varies depending on the type of pension or scheme, sometimes it can take quite a while to trace your pension(s) it can also depend on how many pensions you have, where they are held and the information you can supply findapension.ie with.

We will provide an estimated timeframe based on the information you provide us with.

Do you offer pension advice when my pension has been found?

findapension.ie seeks to find your missing pension and can provide further information on the current pensions environment. If you elect to we can provide you with advice tailored to you and your own circumstances following on from our report being received.

Further Information

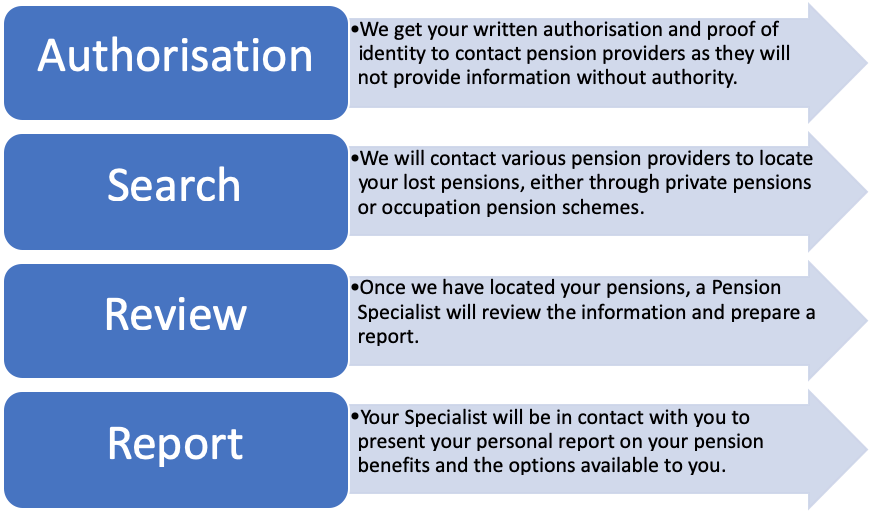

How Does The Service Work?

Why Use FindaPension.ie?

Findapension.ie and KM Financial have been advising members of the public on how to find their pensions since 2016.

If you are just curious about whether or not you have any pensions, or if you are sure that you have lost track of your pension, then we can help you.

We also offer a full pension review for those who already have pensions but need advice on what to do with them

Findapension.ie will find and review your pension which can help you become more financially secure and also benefit you at retirement.

We can help you or family members who wish to search for existing pensions, if we have their written authorisation, we can trace pensions on behalf of a loved one such as a sibling or a parent.

As long as we have written authorisation from them and proof of identity, then we can also trace their pensions.

We are able to answer any questions you may have, which provides you with a level of support on retirement and pensions decisions you may not have previously had

Service guarantees:

- clarity on the existence on your pensions

- current details and values for your pension when found

- Further assistance once pensions have been traced regarding your retirement options.

Why Is a Pension Specialist Important?

As part of our process, you are assigned a pension specialist who compiles a report on your pension and outlines the options available. They are highly trained specialists who will produce a review report for your benefit:

What is included in your pension review?

- The value of each of your pensions

- A projection of funds at retirement

- A comparison with an alternative solution (if any) as per current Pension rules

- The current investment strategy and other important information about your pension

Following on from this comprehensive report and working with you, your adviser may be able to advise on some or all of the following depending on your own personal circumstances

- Whether you will be at an advantage making a transfer to an alternative scheme, buyout bond, prsa or pension or retiring your pension.

- What other features you would like to incorporate, , such as lifestyle strategies, different investment funds, share dealing, being able to view your pension online among others.

- They can if required assess the risk you are prepared to take (if any) and construct a recommended portfolio.

- They will recommend a course of action based on your circumstances.

Your Pension Review

Using our specialist for your pension review can help you on your way to achieving the income and lifestyle you desire at retirement.

you have already made a great start by funding a pension, but it is important to manage it proactively to reduce the chance of disappointment at retirement. The size of your final pension fund will determine how much income you have at retirement. The impact of excessive charges, poor performance or delays in addressing contribution shortfall will have a dramatic impact on your fund and potential retirement income.

findapension.ie pension review will highlight potential issues and help you to address them as well as detailing the benefits you can expect at retirement and how much of a tax-free or taxable cash lump sum is available to you now and/or when your retire.

Professional Financial Advice

Once we trace your pensions a Fully Regulated Qualified Financial Adviser and pension specialist will contact you to produce your pension report and provide your pension review.

Your allocated adviser will provide you with comprehensive financial advice, to help you understand what you have, your options and help ensure you make the right decisions at the right time.

How Do People Lose Their Pension?

It’s easier than you think to lose track of your pension.

It’s worth checking to see if you have any lost or forgotten about pensions, even if you are aware of some pensions you may have. We can give you the certainty you need with regards to your pensions benefits and values

Moving address

Moving can cause you to lose track of your pensions; this is because a pension provider traditionally will try and contact you via post – If you do not update your address with your pension provider, then they will continue to try and contact you at your old address. Once they receive their letters back, they will mark you as ‘not known address at this address’ and will stop sending correspondence.

Changing your name

Suppose you have changed your name, or you have recently married. In that case, providers usually are unable to locate a record of your policy because your policy was under your maiden name. If they do manage to find your policy, then they will require proof of your previous and current name (marriage certificate).

Losing paperwork

Losing track of any pension paperwork happens, old documents get thrown out or misplaced, email addresses change or passwords are forgotten. Losing the paperwork which contains all of the policy numbers you may need, including any details about pension schemes added to the time you may have last had contact with a pension provider can create a nightmare when you come to retirement.

New contact number

Changing your contact number can also mean that pension providers may not be able to contact you, especially if you have also moved address (as mentioned above).

Pension schemes or pensions transferring

Sometimes a pension scheme that you were enrolled in, may either be transferred to another provider or to a personal retirement bond as a result of a company wind up.

What is a pension transfer?

A pension transfer is the process of transferring or switching the fund you have built up in one pension scheme or policy to another scheme or policy.

Reasons for Transferring Pensions

You may wish to do this because:

- you are changing jobs

- you are unhappy with the benefits,

- you are unhappy with performance,

- you are unhappy with fees or security of your current pension scheme.

- you have several pension schemes, you may also wish to try to transfer them all into a one pension to make them easier to manage.

- You may wish to retire earlier and are looking at your options

But, it is important to make sure you know what you’re giving up before moving to a new pension scheme.

How does a pension transfer work?

If you would like to transfer your pension, findapension.ie can arrange this for you. We can organise Leaving Service Options and complete necessary forms in order to transfer your pension from one provider to another. It is important to note that a transfer value is not guaranteed and can change on a daily basis, depending on what you are currently invested in.

If you have a defined benefit or final salary pension, this will have has a cash equivalent, in a lot of cases you may be likely to be worse off if you transfer out of a defined benefit scheme, depending on the incentive that your previous employer may give you to transfer out.

As a general rule, it is only really worth transferring if the value of the fund is £10,000 or more. You shouldn’t transfer it if your current pension has guarantees, for example guaranteed annuity rates, which may be higher than currently available market rates.

Seek Professional Advice

Pension transfers can be a highly complex area as there are many issues to consider before deciding whether a transfer will benefit you (such as what type of pension you are considering switching from and whether any transfer charges imposed will outweigh the benefits). Consequently, it is a good idea to take professional advice before making a pension transfer.

Pension Transfer

Are you thinking about transferring your pension or considering switching your personal pension or company pension. You should ask yourself these questions:

- Is my pension doing as good as it should be, in comparison to other investment options?

- Will I have enough income in retirement from my current pension?

- How do I know how my pension performing?

What are the charges? - How is my pension fund invested?

- Who is managing my pension fund?

- Is my pension still suitable for me?

- I am no longer paying into my pension, should I switch it to a more suitable pension option?

I have an existing pension and I want some advice

Complete our form here and one of our expert Pension Advisers will call you back & arrange a free, no-obligation pension review.

Pension Advice Review in 5 Easy Steps

- Sign a Mandate – Allows us to work on your behalf

- Gather Information – We’ll contact your pension provider and obtain all relevant details of your pensions

- Prepare a Financial Review – We’ll then gather all relevant information about you and your financial circumstances to ensure that we can prepare a full report

- Explain the Options – We’ll explain all the options available to you based on the information collected.

- When you Proceed – All the paperwork is arranged for you and processed as quickly and efficiently as possible. Throughout this process we’ll always be in touch and keep you informed.